Note: In this section, we provide some brief background information on STX and the Stacks Network. Feel free to skip to the next section to begin the tutorial.

What are STX tokens?

Stacks (STX) is the native token asset of the Stacks Network.

As the native token, STX can be used to pay for transaction fees, execute and deploy smart contracts, and buy and sell NFTs. You can also “stack” your STX tokens for Bitcoin rewards, with an average 8% APR in 2022 according to Messari Crypto.

What is the Stacks Network blockchain?

The Stacks blockchain ‘stacks’ on top of the Bitcoin blockchain as a second layer, bringing smart contracts, NFTs, and other DeFi applications to the Bitcoin ecosystem. Stacks blocks are logged directly in Bitcoin blocks with cryptographic hashes.

OK, so how do you buy Stacks tokens?

How to buy Stacks (STX) in 4 Easy Steps

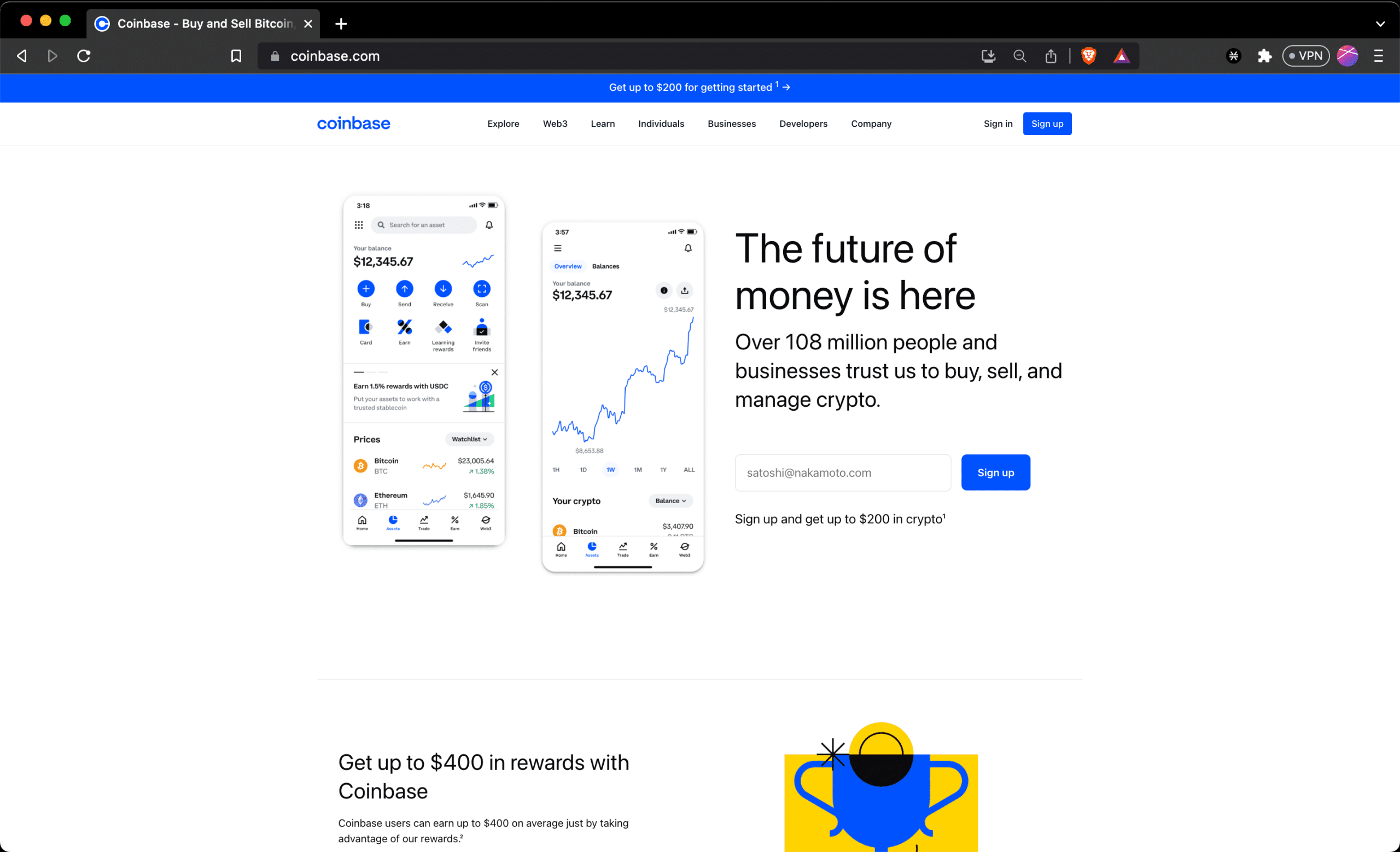

Step 1: Sign Up On a Fiat-to-Cryptocurrency Exchange

If you already have an exchange account for buying crypto, skip to the next step. But make sure they allow you to purchase STX tokens.

In the USA, the simplest option would be Coinbase. Outside of the USA, there are many other options including Binance, KuCoin, OKX, or Bybit.

If none of those are available in your country, check out the markets section for STX here on CoinMarketCap.

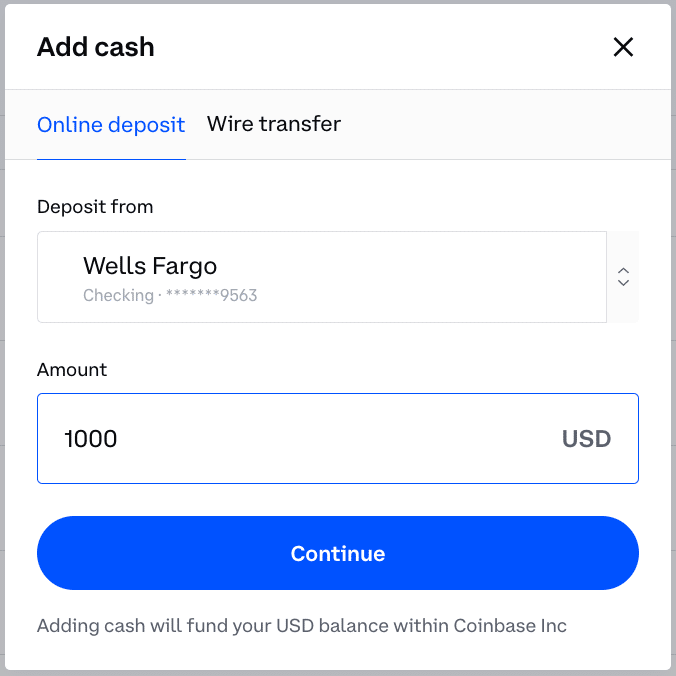

Step 2: Deposit Fiat Currency (like USD) to Exchange

Once you’re registered on an exchange that supports STX, you’re ready to deposit USD or another fiat currency.

Note: If you deposit fiat currency with a bank account, debit card, or credit card, most exchanges will make you wait several days to withdraw any cryptocurrency you purchase.

If you need to speed up the process, you can deposit money with PayPal (at least on Coinbase) or just use MoonPay to buy STX and have access to your funds instantly. The downside is that these methods will charge higher fees.

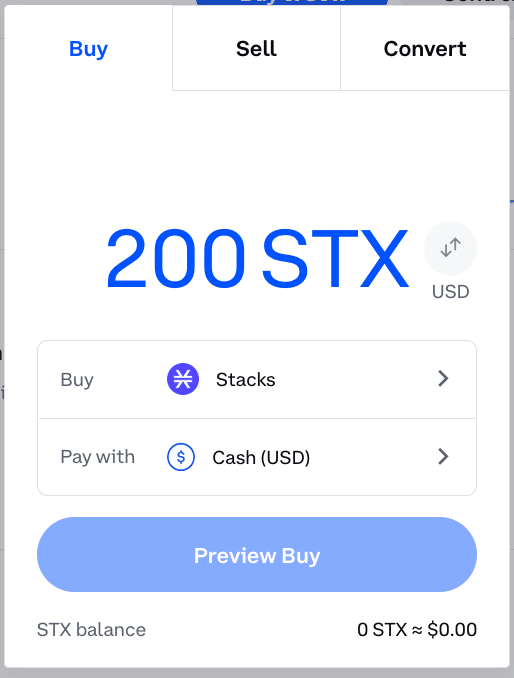

Step 3: Exchange Fiat Money for STX

Now it’s time to buy STX with your fiat currency. The price of STX at the time of this writing is $0.89 USD, so we will buy 200 STX for $178 USD (not including trading fees).

Most exchanges charge trading fees. On Coinbase, they range from 0.5% to 4.5% depending on multiple factors including the volume you buy.

Once you have purchased STX tokens, we recommend that you withdraw your STX to a non-custodial wallet for security purposes.

What does that mean?

Put simply, when an exchange stores your cryptocurrency, they are your “custodian.” You have to trust them to store your assets safely and not gamble with them.

And as we saw with the $8 billion FTX fraud where many users lost everything, it is much safer to keep your coins in your own wallet instead of trusting exchanges to do it for you.

Step 4: Withdraw STX to Your Own Wallet

To withdraw STX to your own wallet, you first need to set up a wallet.

Best Cryptocurrency wallets to store STX

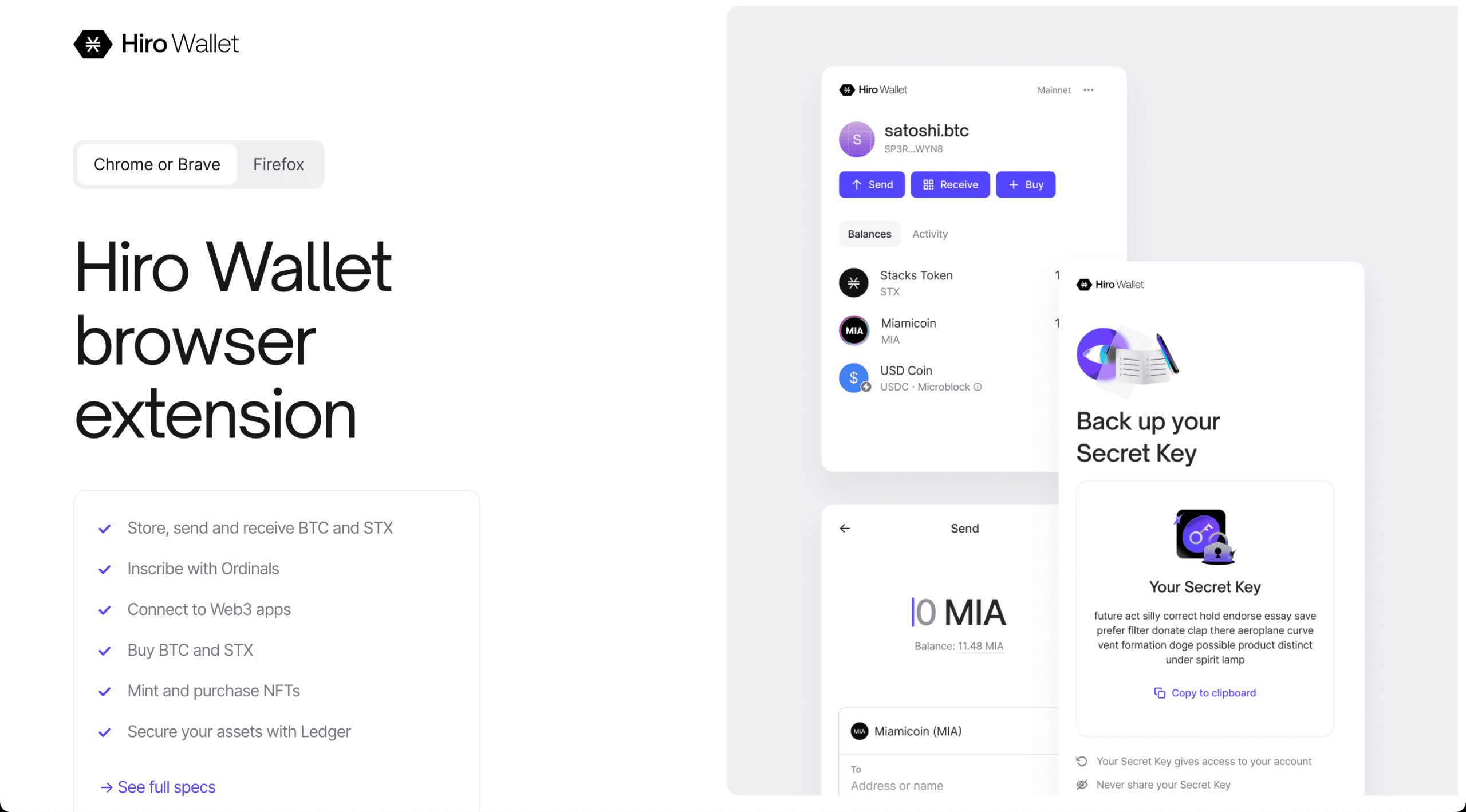

Best For Desktop: Hiro Wallet

Note: Hiro Wallet has rebranded to Leather. It still works almost exactly the same.

If you use a Desktop computer, we recommend Hiro Wallet for storing STX.

You can install Hiro Wallet here, or for an in-depth tutorial see How to Set Up a STX Wallet.

Hiro Wallet is a browser extension wallet similar to Metamask for Ethereum.

Hiro Wallet will enable you to:

Send and receive STX tokens

Login to Web3 Applications

Send and receive Bitcoin Ordinals

The only con is that Hiro Wallet has no mobile app.

For mobile, you’ll need Xverse Wallet.

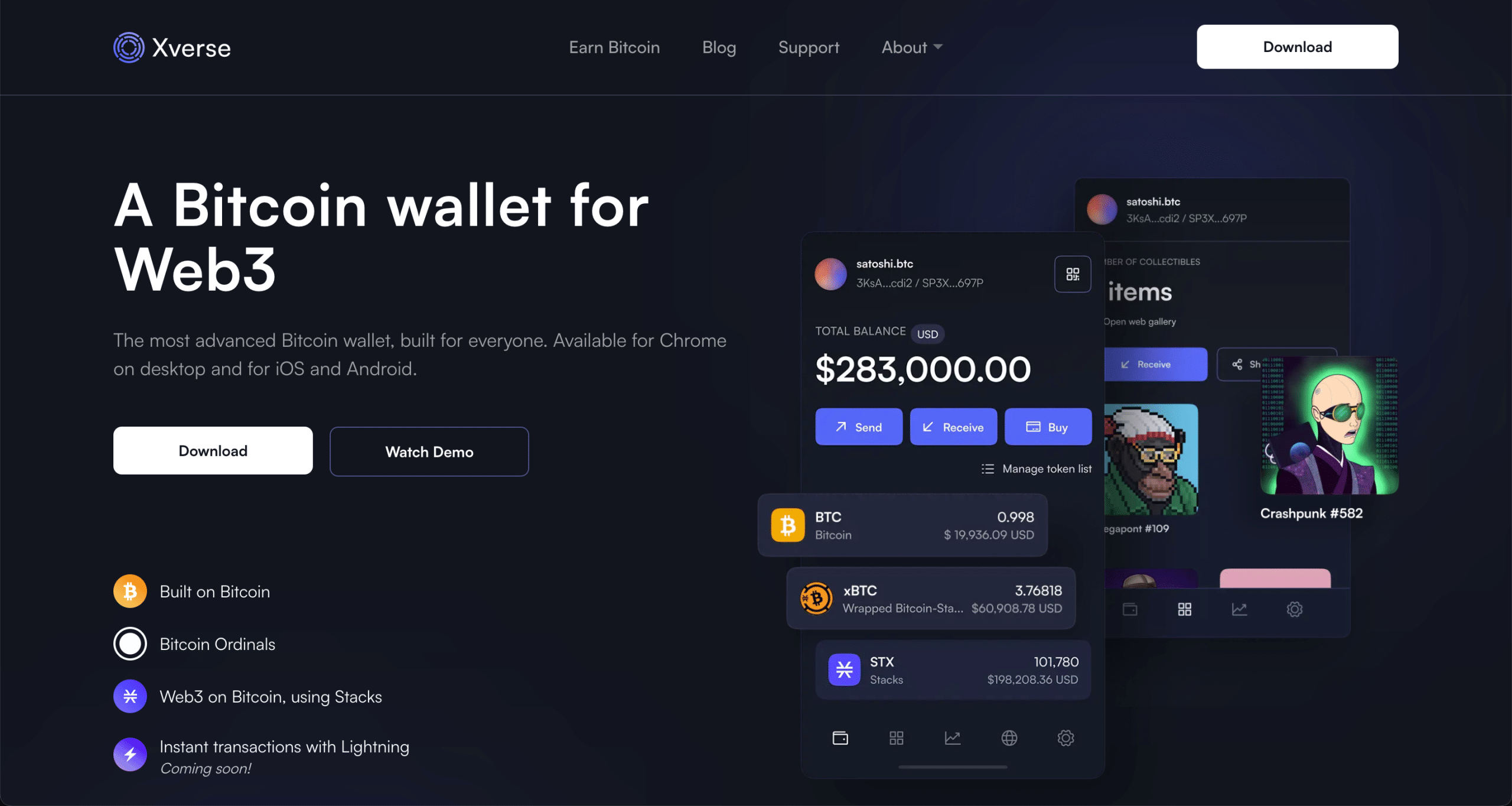

Best For Mobile: Xverse Wallet

If you want to send and receive STX tokens on iOS or Android, you’ll need Xverse Wallet.

Xverse has many of the same features as Hiro Wallet, but it also has a mobile app for iOS and Android.

You can install it here.

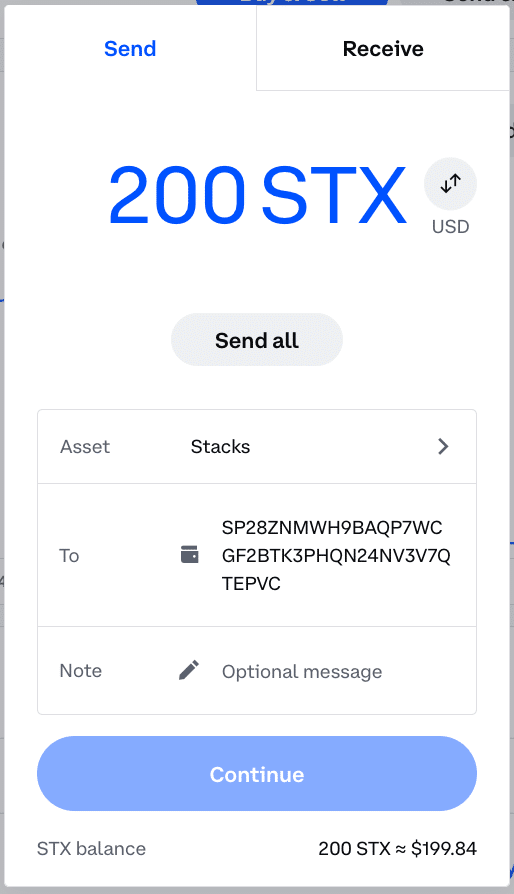

Withdrawing STX to your wallet

Once you have set up your cryptocurrency wallet, it’s time to withdraw STX tokens from the centralized exchange.

You’ll need to copy and paste your wallet address to withdraw your STX and select an amount. It will likely take around 10 minutes from the time your withdrawal is processed.

What to do next

Now that you have STX tokens and a Stacks wallet set up, you can interact with the Stacks ecosystem. Congratulations!

For example:

Buy and sell digital assets like NFTs on Gamma

Buy a .btc name to use as your username

Use Web3 apps like ALEX (DeFi) and Console (decentralized blogging)

Write and deploy Clarity smart contracts

Stack your STX to earn Bitcoin (see how below)

How to Stack Your STX to Earn Bitcoin

One of the unique aspects of the Stacks Network is that it’s possible to earn BTC rewards by locking up or “stacking” your STX tokens temporarily–a process which supports the security mechanism of the network.

This can be an attractive option because as we mentioned earlier, the average yield for stackers in 2022 was 8% APR! (paid in bitcoin)

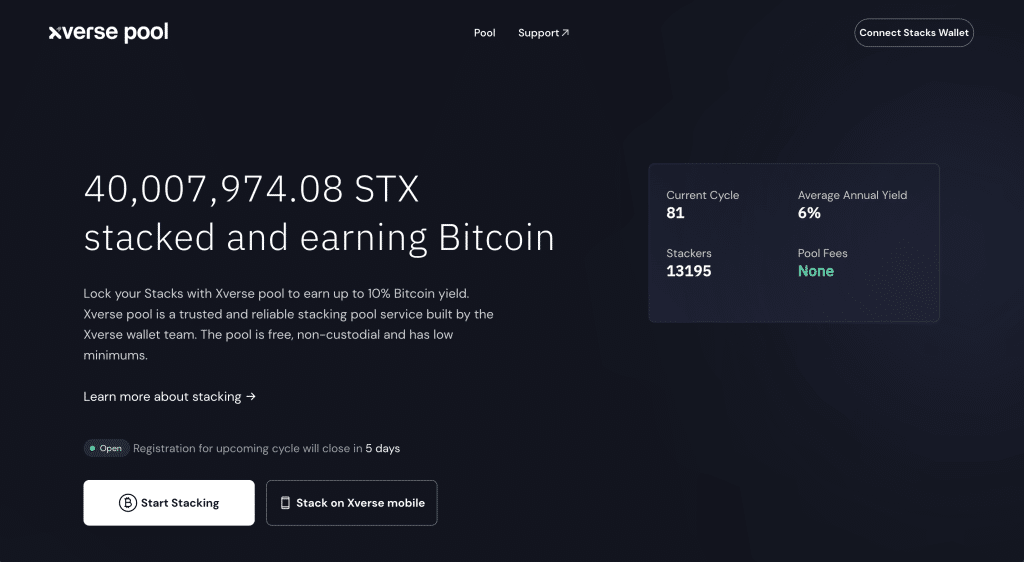

To stack your STX and earn Bitcoin yield, you need to join a Stacking Pool such as Xverse Pool (100 STX minimum).

Simply go to the Xverse Pool, click “Start Stacking,” and you can lock your STX tokens up to earn BTC every stacking cycle.

Note: You must have Hiro or Xverse wallet setup to stack STX. But some exchanges–like Binance–can do it for you if you don’t have a self-custodial wallet.

A stacking cycle lasts about two weeks (every 2100 Bitcoin blocks), so your STX tokens will locked up for that time period. Afterwards, you will be paid in Bitcoin.

To learn more about stacking, click here.

STX Tokenomics

Current Market Cap

Currently, the market cap of STX is $1,215,805,333.84 USD, and the price is $0.77 USD.

Total Supply

The circulating supply of STX is about 1.45B, and the maximum supply is 1.82B.

New tokens are minted and distributed to Stacks miners as rewards for keeping the network secure.

Is Stacks (STX) a Good Investment?

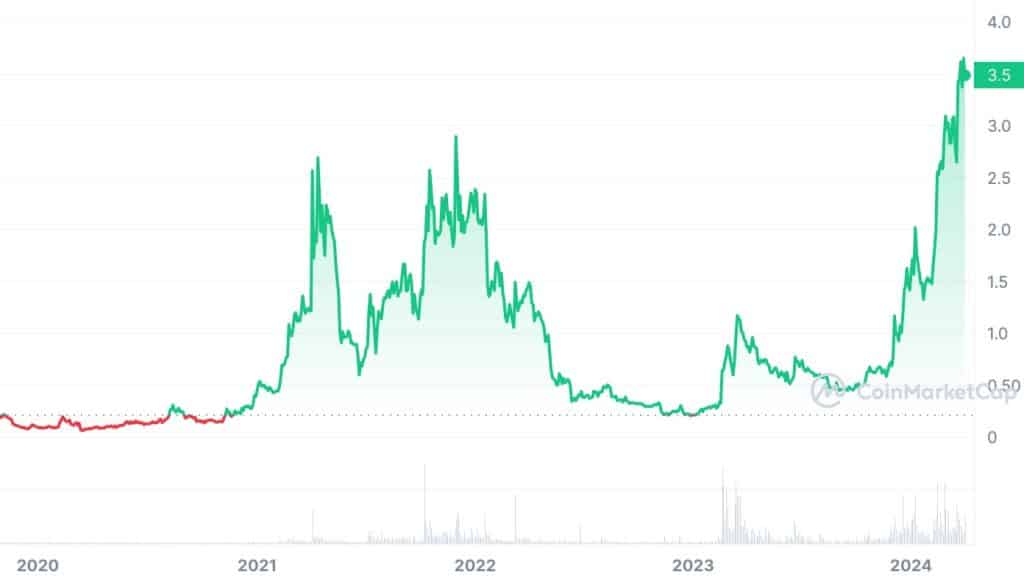

From September 2019 to April 2024, STX increased in value roughly 10x from $0.33 to $3.50, falling to its previous low several times. So like most cryptocurrencies, it is very volatile.

If you want to trade cryptocurrencies like STX, we recommend that you do your own research and don’t invest more than you can afford to lose.

Past performance is not indicative of future results, and all cryptocurrencies can be risky investments.

Frequently Asked Questions (FAQ)

There are currently 1.45 B STX tokens in circulation.

The Stacks blockchain is secured with the novel Proof of Transfer (PoX) mining mechanism.

You can trade, convert, or sell STX on an exchange like Coinbase or Binance.

The best place to buy Stacks in the USA is Coinbase. In the rest of the world, Binance, OKX, and Bybit will work.